Year-End Prep for Small Businesses: 10 Tasks to Complete Before 2026

- Taylor Vanderburgh

- Dec 17, 2025

- 3 min read

As 2025 draws to a close, the excitement for a new year begins to build. However, before you ring in 2026, it’s crucial to get your business affairs in order!

The end of the year often brings a flurry of activity for small businesses. For many, December 31 marks the end of the fiscal year, leading to a mad dash to finalize tasks while also enjoying precious family moments during the holidays.

Even if your fiscal year doesn’t end in December, taking proactive steps now can set you up for success in 2026. Here’s a checklist to help you prepare for the upcoming year.

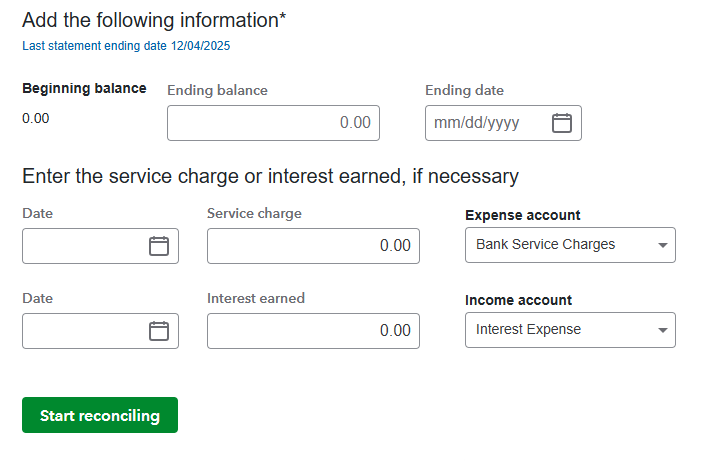

1. Reconcile Bank and Credit Card Accounts

Verify your accounting records against your bank and credit card statements. Use the Reconcile function in QuickBooks to ensure your balances align. Don’t forget to account for any fees or interest charges. This can be done right in the Reconcile module of QuickBooks Online:

Additionally, check for old uncleared transactions, such as checks older than six months, which may now be stale-dated.

2. Review Accounts Payable

Take stock of your outstanding obligations. If you’re using QuickBooks Online Essentials or Plus, run an Accounts Payable Aging Report. Look for any old bills—these could be duplicates that need to be voided.

Request final invoices from suppliers for 2025 to ensure you have everything needed for tax purposes. If you file GST/HST returns, remember to adjust for any missing bills in your next filing.

3. Review Accounts Receivable

Pull an aging receivables report to see who still owes you. For any uncollectable invoices, make the necessary entries for Bad Debt expense.

4. Review Financial Reports

Gain insights into your business’s performance by pulling key financial reports:

Balance Sheet

Profit and Loss (Income Statement)

Statement of Cash Flow

Look for discrepancies and compare results to prior years using QuickBooks Online’s comparison feature.

5. Prepare Tax Documents for Your Accountant

Gather your financial reports and review them for accuracy before sharing them with your accountant. Ask for a year-end checklist, which may include auto expenses, home office costs, and loan statements.

Granting your accountant access to your QuickBooks Online file can also make year-end smoother and more efficient.

You can do this by heading to the ⚙️ Gear icon, and under Your Company, click Manage users.

6. Backup Your Data

Use the holiday break as an opportunity to back up your data. If you haven’t already, consider a big-name cloud-based storage solution like Google Docs, iCloud, Microsoft OneDrive, or Dropbox. Regular backups are essential for protecting your business information.

7. Conduct an Inventory Count

If your business carries physical inventory, now is the time for a count. Consider using an app to streamline the process. QuickBooks and many Point-of-Sale (POS) systems offer integrations that help automate inventory tracking.

8. Double-Check Payroll

Generate a payroll summary report for 2025 and ensure your payroll liabilities match your PD7A remittances. Address any discrepancies promptly. If applicable, review worker's compensation (i.e. WSIB) balances as well.

9. Update Contact Information

Request updated information from employees, customers, and suppliers. Accurate records are essential for filing T4s, T4As, and T5018s and for following up on outstanding receivables in the new year.

If you process payroll with QuickBooks or Wagepoint, this can be easily done by the employees themselves within their app.

10. Assemble a Mileage Log

If you use a vehicle for business, ensure your 2025 mileage log is complete. Accurate tracking helps support deductions and prepares you in case of a CRA audit. Apps like Everlance or QuickBooks’ mileage tracking feature can simplify this process.

Final Thoughts

Once you’ve completed your year-end tasks, take a moment to look ahead to 2026. What goals do you want to achieve? Identify small, consistent actions that can help move your business forward throughout the year.

Don’t forget to schedule company events — and your well-deserved vacation — in 2026. You’ve earned it!

If bookkeeping feels overwhelming or you need a one-time cleanup before year-end, contact us for a free quote on our services.

Comments